In today’s rapidly evolving financial world, building a diversified investment portfolio is more important than ever.

Whether you’re starting with $100 or $100,000, diversification is the key to reducing risk, protecting your savings, and accelerating financial growth.

And here’s the good news:

In 2025, you don’t need to be wealthy to invest smartly. With the rise of fractional shares, low-cost ETFs, and global investment platforms, anyone can create a strong, balanced portfolio—even on a tight budget.

This guide will walk you through practical steps to build a diversified investment portfolio tailored for 2025 and beyond.

What Is a Diversified Investment Portfolio?

A diversified investment portfolio spreads your money across different asset classes—stocks, bonds, real estate, commodities, and cash equivalents—to minimize the impact of a poor-performing asset on your overall returns.

Think of it as not putting all your eggs in one basket.

By diversifying, you increase the likelihood that when one sector struggles, another sector’s growth will help balance your portfolio’s performance.

Why Diversification Matters in 2025

| Reason | Explanation |

|---|---|

| Economic Uncertainty | Global markets are more interconnected and volatile. |

| Technological Disruptions | Innovations like AI and blockchain reshape industries rapidly. |

| Inflationary Pressures | Diversification helps hedge against currency and inflation risks. |

| Broader Access to Markets | Investment apps offer access to global stocks, crypto, and REITs with minimal capital. |

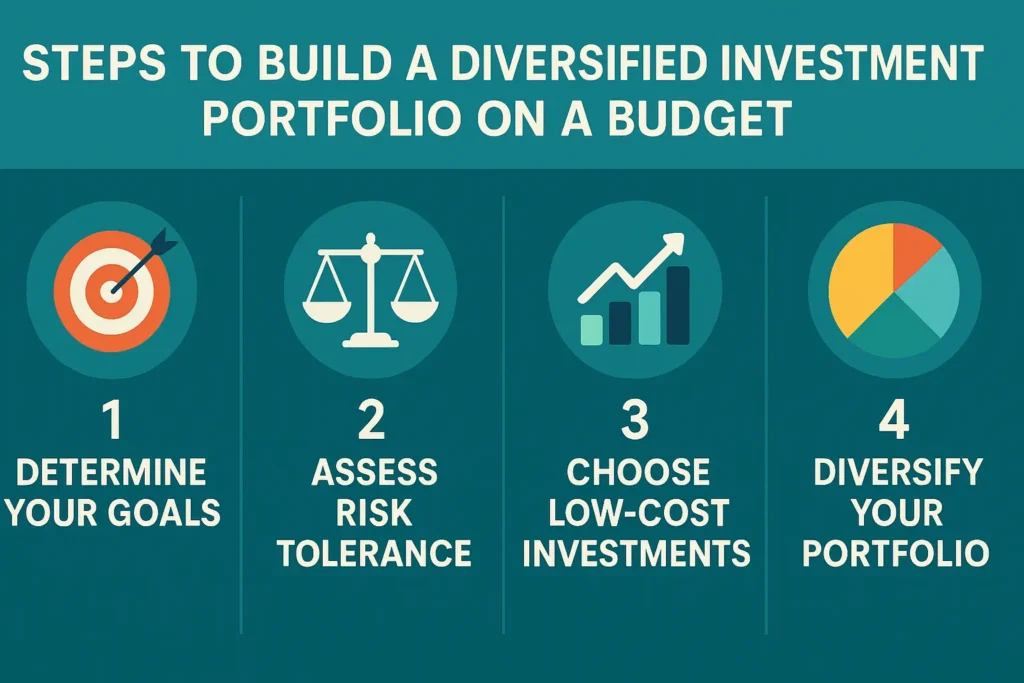

Steps to Build a Diversified Investment Portfolio on a Budget

1. Define Your Financial Goals and Risk Tolerance

- Short-term goals (1–3 years): Prioritize liquidity and capital protection.

- Medium-term goals (3–7 years): Balance growth with moderate risk.

- Long-term goals (7+ years): Focus on growth assets like stocks and real estate.

Risk Tolerance Tip:

Ask yourself, “Can I sleep peacefully if the market drops 20% tomorrow?”

If not, adjust your allocation toward safer assets.

2. Choose the Right Asset Classes

For beginners in 2025, a well-diversified budget-friendly portfolio may include:

| Asset Class | Examples |

|---|---|

| Stocks | Global stock ETFs, S&P 500 Index Fund |

| Bonds | Treasury Bonds, Corporate Bond Funds |

| Real Estate | REITs (Real Estate Investment Trusts) |

| Gold & Commodities | Gold ETFs, diversified commodity ETFs |

| Cash or Cash Equivalents | High-yield savings accounts, money market funds |

3. Start with Low-Cost, Broad-Market Funds

Index Funds and ETFs are ideal for small investors.

They offer automatic diversification across hundreds or thousands of companies.

Best ETFs for Diversified Exposure:

💼 Open Your Low-Cost Investment Account

Ready to start investing smartly? Get started with trusted, low-fee platforms like Vanguard or Fidelity — ideal for long-term, goal-based investing.

4. Invest Consistently Through Dollar-Cost Averaging (DCA)

Even if you can only invest $50 or $100 per month, consistency is more powerful than timing the market.

Set up automatic monthly investments to smooth out the highs and lows of the market.

5. Rebalance Your Portfolio Regularly

Markets move, and so should your allocations.

Rebalancing Tips:

- Review your portfolio every 6 or 12 months.

- Adjust back to your original target (e.g., 70% stocks, 30% bonds).

- Avoid excessive rebalancing, which can lead to unnecessary fees and taxes.

6. Expand Geographically

Don’t restrict your investments to your home country. Global diversification helps protect against localised recessions.

Include:

- Developed Markets (USA, Europe, Japan)

- Emerging Markets (India, Brazil, Southeast Asia)

Example ETF:

Sample Diversified Portfolio for Beginners (2025)

| Asset | Allocation (%) |

|---|---|

| Global Equity ETF | 50% |

| Bond ETF | 20% |

| REIT Fund | 15% |

| Gold ETF | 10% |

| Cash Reserve | 5% |

(Adjust based on your personal risk tolerance.)

Mistakes to Avoid

- Putting all your money into a single stock.

- Ignoring global investment opportunities.

- Chasing “get-rich-quick” cryptocurrency or meme stocks without proper research.

- Forgetting to rebalance periodically.

Conclusion

In 2025, building a diversified investment portfolio is easier, more affordable, and more critical than ever. You don’t need a fortune to start. You need clarity, consistency, and courage.

Even with a small monthly investment, diversified across multiple asset classes, you can set the foundation for long-term financial independence.

Start today. Your future self will thank you.

Leave a Comment