If you’ve ever wondered how to retire early and achieve lasting financial freedom, the FIRE movement may be the lifestyle strategy you’ve been looking for. FIRE, short for Financial Independence, Retire Early, is a global personal finance movement that encourages individuals to save aggressively, live intentionally, and invest wisely to retire years—if not decades—before the traditional age. This in-depth beginner’s guide explores everything from FIRE basics to advanced techniques to help you build your roadmap to early retirement.

For more foundational budgeting tips, check out our guide on how to create a monthly budget that works.

What is the FIRE Movement?

FIRE (Financial Independence, Retire Early) is a wealth-building philosophy centered on the idea that with a high savings rate and consistent investing, you can achieve financial independence and choose whether or not to work.

Three Main Types of FIRE:

- Lean FIRE: You live a frugal, minimalist lifestyle and retire on a relatively modest annual budget. Ideal for low-cost regions.

- Fat FIRE: You retire early but maintain a higher standard of living. This requires more savings and higher investment returns.

- Barista FIRE: You save enough to cover most of your expenses with investments but choose to work part-time for supplemental income or benefits like healthcare.

Why is FIRE Trending Worldwide?

- Disillusionment with traditional work

- A desire for more freedom and autonomy

- Rise of remote work and global gig economy

Recommended Read: Top Passive Income Investment That Actually Work

Who Can Join the FIRE Movement?

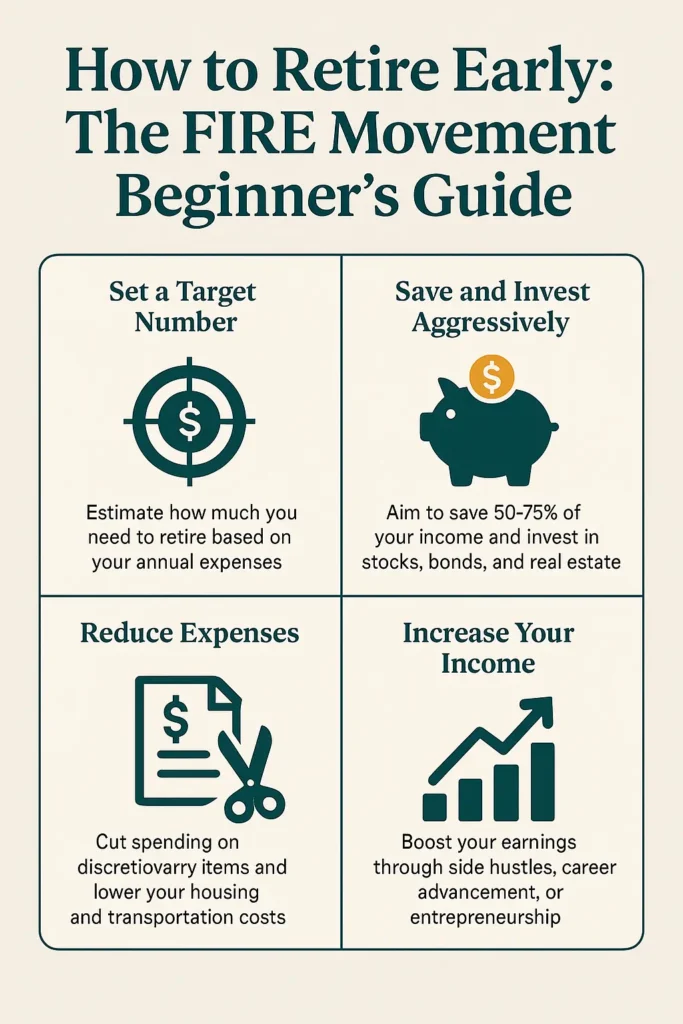

How to Retire Early: Steps for Success

FIRE is not just for tech workers or high-income earners. Anyone can work toward FIRE with the right mindset, even those with modest incomes. The core of the movement is intentional living and strategic money management.

FIRE is ideal for:

- Millennials seeking freedom from corporate burnout

- Gen Z interested in location-independent living

- Professionals in high-stress jobs seeking alternatives

- Couples planning long-term travel or family time

Whether you earn $30,000 or $130,000 annually, adopting FIRE habits can drastically transform your financial future.

Core Principles of the FIRE Strategy

1. Track Every Expense

Use personal finance apps like GrowUrFunds Wealth Manager(Currently in Development Mode), Mint, or YNAB to track every dollar. Understanding your spending habits is step one.

2. High Savings Rate

Most FIRE advocates save between 50% to 70% of their monthly income. This accelerates the compounding effect of investments.

3. Invest for Long-Term Growth

Let your money work for you:

- Low-fee index funds (e.g., Vanguard Total Market Index)

- Real estate rentals or REITs

- Dividend growth stocks

- Global ETFs or tax-advantaged retirement accounts

4. Cut Back and Optimize Spending

From cooking at home to living in a smaller space or cutting subscriptions, FIRE requires you to eliminate wasteful spending.

5. Know Your FIRE Number

Your FIRE number is the total portfolio value needed to retire early.

FIRE Formula:

Annual Living Expenses × 25 = FIRE Number

If your annual expenses are $40,000, your FIRE number = $1,000,000.

Steps to Begin Your FIRE Journey

Step 1: Understand Your Finances

Start with a zero-based budget. Track fixed and variable expenses. Know your income streams. Tools like GrowUrFunds Budget Planner can help.

Step 2: Eliminate High-Interest Debt

Debt is the biggest enemy of early retirement. Prioritize credit cards, personal loans, and high-interest auto loans.

Step 3: Build an Emergency Fund

Store 3 to 6 months’ worth of expenses in a liquid, high-yield savings account. It protects you from setbacks without derailing your FIRE plan.

Step 4: Boost Your Income

FIRE is not just about saving—earning more is crucial. Take up freelance work, sell digital products, create online courses, or negotiate better pay.

Step 5: Automate & Invest Consistently

Use auto-investing apps to regularly invest in ETFs or target-date funds. The earlier you start, the more you benefit from compound growth.

Mistakes to Avoid on Your FIRE Path

- Forgetting Inflation: Your expenses may double in 20 years. Plan accordingly.

- Underestimating Healthcare Costs: Especially if retiring before government coverage begins.

- Overinvesting in One Asset Class: Diversification is key to protecting your nest egg.

- Ignoring Tax Efficiency: Use Roth IRAs, HSAs, and tax-loss harvesting wisely.

The 4% Rule and Why It Matters

The 4% Rule guides how much you can withdraw annually from your retirement portfolio without running out of money. Based on historical market returns, withdrawing 4% per year is considered safe over a 30-year retirement.

Example:

Portfolio = $1,000,000

Annual Withdrawal = $40,000

However, recent market volatility has led many FIRE followers to adjust their strategy to a 3.5% withdrawal rate or flexible spending methods.

Start Tracking Your Money Like a Pro

Create your free account and unlock a beautiful dashboard to manage your income, expenses, savings goals, and budgets – all in one secure place.

- ✨ Smart Income & Expense Tracking

- 📊 Real-Time Budget Overview

- 🎯 Set and Achieve Saving Goals

- 🔐 Bank-Level Security & Privacy

- 🚀 Upgrade Anytime for Advanced Features

Frequently Asked Questions (FAQs) About FIRE

Can I achieve FIRE with an average salary?

Yes. FIRE isn’t about income—it’s about saving rate, spending habits, and consistency over time.

What if the market crashes after I retire?

A conservative withdrawal rate, emergency fund, and diversified investments can protect you from downturns.

Do I need to stop working completely after FIRE?

No. Many FIRE participants choose to continue working part-time, consult, or pursue passion projects.

How long does it take to reach FIRE?

Depends on your savings rate. Saving 50% of income might take 15–17 years; saving 70% could reduce that to under 10.

Final Thoughts: Is the FIRE Lifestyle Worth It?

The FIRE movement is more than early retirement. It’s about reclaiming your time, minimizing financial stress, and building a life based on freedom, not financial obligation. Even if you never hit your full FIRE number, the habits—saving more, spending wisely, investing regularly—will set you up for a secure future.

By applying these principles, you gain control over your financial destiny and unlock the option to live life on your terms.