Creating a monthly budget is one of the most effective ways to take control of your finances and move closer to financial independence. While the term “budget” might sound limiting or restrictive, a well-planned monthly budget is actually the opposite—it gives you clarity, freedom, and direction. When done right, it helps you align your spending with your values, build consistent savings, and make smarter investment choices. In this guide, you’ll discover how to create a monthly budget that’s not only realistic and easy to follow but also tailored to your lifestyle and long-term goals.

Why Most Monthly Budget Fail?

Understanding why monthly budget often fail is key to building one that succeeds.

Reason |

Solution |

| Unrealistic Expectations | Create achievable targets. |

| No Flexibility | Allow room for spontaneous expenses. |

| Lack of Tracking | Use simple tools to monitor spending. |

| Neglecting Fun | Allocate money for entertainment and hobbies. |

Budgeting isn’t about restriction—it’s about smart financial planning.

How to Create a Monthly Budget That Works

1. Calculate Your Net Income

Start with the amount of money you actually take home after taxes, health insurance, and retirement contributions.

Pro Tip: If your income fluctuates (e.g., freelance work), use your average monthly income based on the last 6–12 months.

2. Track Your Expenses

Spend a full month tracking every dollar you spend.

Include essentials (rent, utilities, groceries) and non-essentials (dining out, subscriptions, shopping).

You can track expenses using:

- A simple spreadsheet (Excel or Google Sheets)

- Budgeting apps like YNAB (You Need A Budget) or Mint

3. Categorize Your Spending

Break your spending into three main categories:

- Needs (rent, groceries, transportation, healthcare)

- Wants (restaurants, entertainment, travel)

- Savings/Debt Repayment (emergency fund, retirement, paying off loans)

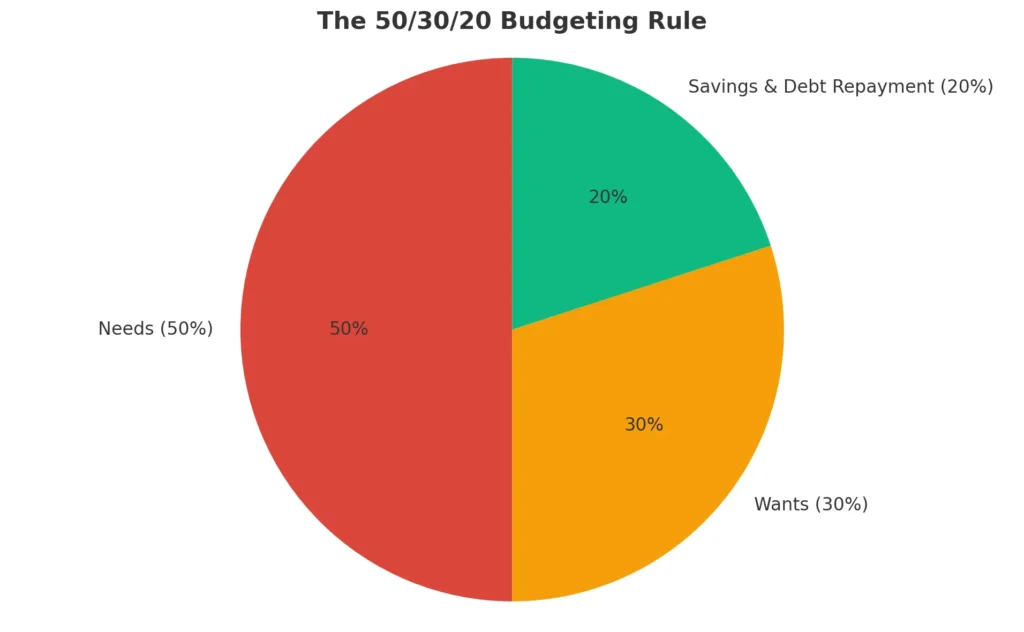

Following the 50/30/20 budget rule is a good start:

- 🟥 50% Needs — essentials like rent, groceries, utilities, transportation

- 🟧 30% Wants — non-essentials like dining out, entertainment, travel

- 🟩 20% Savings & Debt Repayment — emergency fund, investments, loans

4. Set Clear, Specific Financial Goals

Your budget should be aligned with what matters to you:

🎯 Short-Term Goals (0–2 years)

- Build an emergency fund

- Pay off credit card debt

🎯 Medium-Term Goals (3–5 years)

- Save for a home

- Invest for major life events

🎯 Long-Term Goals (5+ years)

- Retirement savings

- Financial independence

(Explore Now: How to Start Saving Money for Investing)

5. Choose a Budgeting Method That Fits You

There’s no “one size fits all” in budgeting.

Choose a method that matches your personality and financial habits.

Popular Budgeting Methods:

- Zero-Based Budgeting: Every dollar is assigned a job.

- 50/30/20 Rule: Balanced and simple structure.

- Envelope System: Allocate physical or digital “envelopes” for spending categories.

- Pay Yourself First: Save/invest a fixed percentage first, then spend the rest.

6. Automate What You Can

- Automate your savings, bill payments, and debt repayments whenever possible.

- Automation removes the temptation to overspend and ensures your financial priorities are funded first.

7. Review and Adjust Monthly

Life changes—and so should your budget.

At the end of each month:

- Review your spending

- Compare actual vs planned

- Adjust for upcoming months (e.g., holidays, vacations, big purchases)

Budgeting is a living document, not a rigid set of rules.

How to Stay Motivated With Your Budget

- Celebrate small wins (like paying off a small debt or reaching a savings milestone).

- Visualise your goals (vision boards, financial trackers).

- Use apps that gamify saving and spending control.

- Remind yourself that budgeting = financial empowerment, not deprivation.

A monthly budget isn’t a prison—it’s a roadmap to the life you want.

When you take the time to create a realistic, flexible, and goal-oriented budget, you’re not just organizing your finances—you’re building a foundation for financial confidence and long-term success. Instead of asking yourself at the end of the month, “Where did all my money go?”, you’ll know exactly how each dollar is working for you. A thoughtfully planned budget isn’t about cutting out everything fun; it’s about prioritising what matters most to you while still covering your needs, preparing for the unexpected, and making room for future goals like travel, investments, or buying a home.

Start with the basics: track your income, list your essential expenses, and allocate a portion for savings—even if it’s small at first. Then, adjust as you go. Life changes, and your budget should too. Consistency is more important than perfection. Even if you slip up one month, the habit of budgeting will gradually build your financial awareness and resilience.

Over time, these small, intentional choices—like brewing coffee at home, automating savings, or planning your meals—will begin to snowball. What feels like a minor shift today could be the reason you achieve major milestones tomorrow. Remember, budgeting isn’t restrictive—it’s empowering. It puts you in control of your money and your future.

💡 Start Simple, Save Smarter

Small habits can lead to big savings. Learn how to cut costs without cutting joy—starting with just a few smart moves this month.

*Easy tips. Real results. No budget burnout.